5 Great Ways to Burn Loyalty Points and Engage Customers

Loyalty programs allow organizations to track, monitor and change customer behavior. Here are nine key performance indicators to track and monitor. Watching these holistically will help you gauge the performance of your business. Taking these loyalty KPIs down to segment and individual levels will help you understand who to target when, creating a mechanism for you to proactively change customer behaviors for the betterment of your business.

CLV is an important metric that lets your brand predict the average revenue you can generate from customers over the entire lifetime of their relationship with your brand, as well as identify the profitability of your customer acquisition strategy. A loyalty initiative allows you to track customer behavior and provides a mechanism for you to proactively increase customer purchases and build the emotional bonds necessary to build long-term customer relationships.

To increase the CLV, leveraging a loyalty program that focuses on the two-way value exchange between your brand and your customers, recognizing their needs, wants and preferences, you’ll build a stronger bond with your customers and, ultimately, create a higher lifetime value.

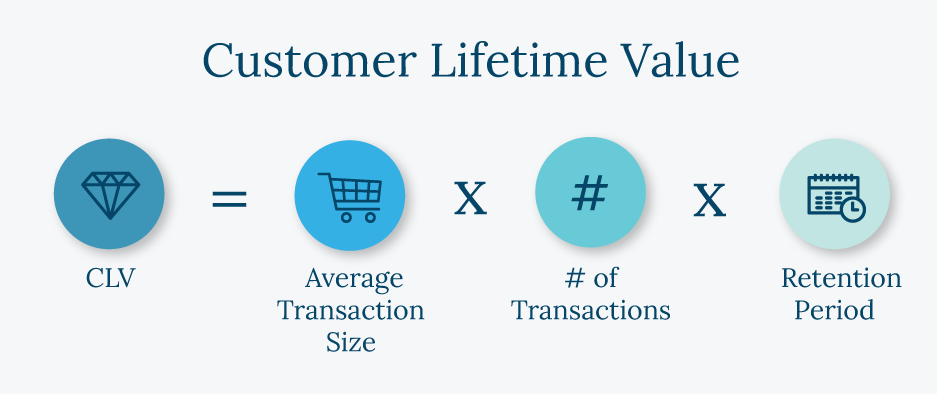

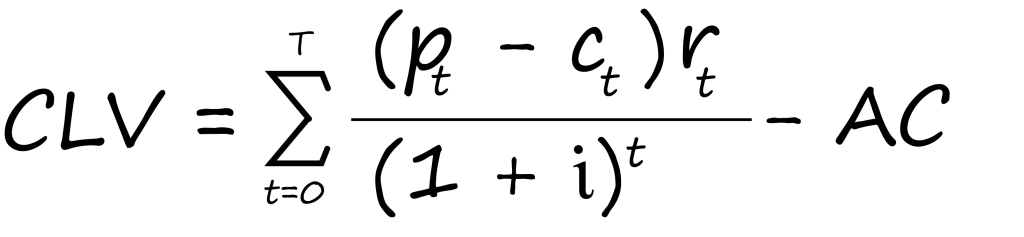

When calculating CLV, you can get very sophisticated or keep it simple.

The simple version:

The more sophisticated version:

Pt = Price paid by a consumer at time t

Ct = Direct cost of servicing the customer at time t

= Discount rate or cost of capital for the firm

rt = Probability of a customer repeat buying at time t

AC = Acquisition cost

T = Time horizon for estimating CLV

Churn refers to the percentage of customers who don’t come back and purchase again. Churn happens all the time during a customer’s lifecycle, but there are two areas where churn is most frequent and most expensive:

Loyalty programs are a great strategy to reduce churn. With a loyalty program you track all types of customer behaviors that lead to retention. By tracking those behaviors you can not only put triggers in to celebrate the right behaviors but, more importantly, add triggers the moment their behavior changes. You can significantly reduce your churn rate with an effective loyalty program and value-based customer engagement strategies.

Mala Raj, Managing Partner at Strategic Caravan International, India, discussed possible ways to reduce churn on the Let’s Talk Loyalty Podcast, episode #66:

“The way you define activity and therefore churn will vary depending on the industry you operate in. For example, within grocery retail a customer would be expected to frequent at least monthly if not weekly, whereas for an apparels company you would be expected to purchase maybe a couple of times a year. So, depending on the nature of your business, you’d define activity and churn. But as a generic figure, you should plan to reduce churn 10 to 12 percent at least in the first couple of years of your loyalty program. Loyalty as a discipline is accountable, and it’s very important to put those numbers down. When we talk loyalty, we are not just talking about growth and development of existing members, we are also talking about retaining them over a longer period than they would have stayed otherwise and therefore churn is an important metric.”

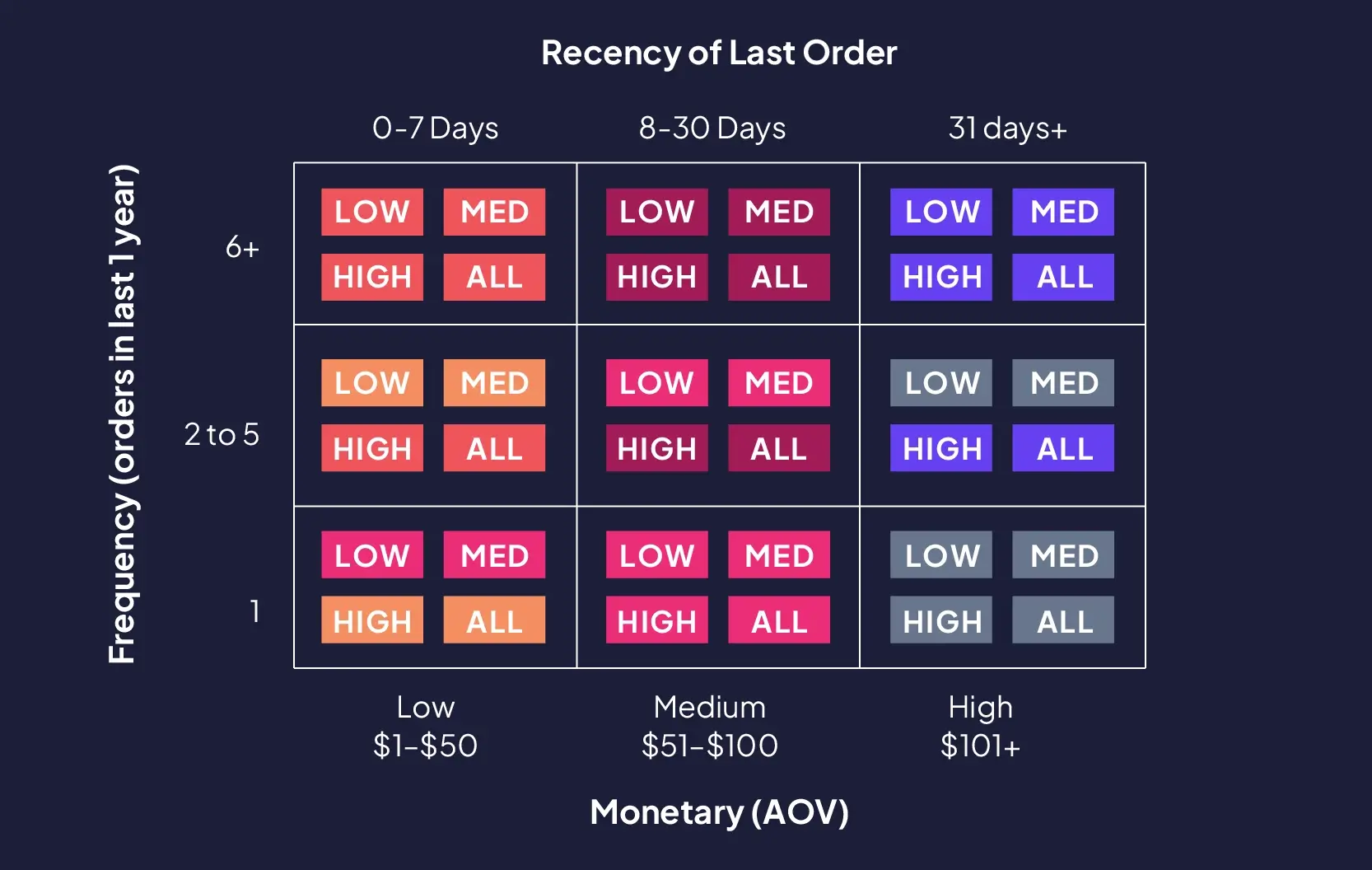

RFM modeling is a method for analyzing customer value. It’s made up of three dimensions:

Recency – How recently did the customer purchase?

Frequency – How often do they purchase?

Monetary value – How much do they spend on average?

One approach to RFM is to assign a score for each dimension on a scale from 1 to 10. Annex Cloud’s Loyalty Experience Platform™ enables advanced segmentation.

Valentin Radu, CEO of Omniconvert on the Marketers Mastermind episode #7 of Let’s Talk Loyalty said:

“RFM is a concept dating back to the 70s where companies would choose which customers to go after in order to save marketing cost. Today in the digital age, it is not that expensive to send emails but you can be more relevant. Thanks to RFM segmentation, customers are divided into different categories based on their RFM metrics. For example, we have Super Consumers often labeled as “Soulmates”, these are the customers who purchase most recently, frequently and highest monetary value. Brands now are focusing on being more relevant and providing value to their customers. In order to stand out in the current competitive eCommerce or retail space, RFM segmentation is extremely important to move the needle and become customer-centric.”

The customer engagement rate or score shows how proactively and enthusiastically members interact with your brand. Measurement includes each interaction with your brand. Some common examples, but not limited to include:

Customers who engage or interact with a brand in addition to transact spend 250% more than customers who just transact. A loyalty program that includes recognizing and rewarding customers for sharing experiences, writing reviews, and referring friends and family creates a mechanism to encourage these interactions.

Here’s another metric to track at the macro and micro levels. Understanding your overall average order value is an important metric to watch to predict future revenue. Most B2B and B2C organizations watch their AOV, then implement tactics to raise that amount. Watching this metric allows you to understand where and when to discount or hold price.

You can watch AOV on a segment or individual level. If the number continues to hold or rise, you’re on the right track. If you’re seeing dips, you’ll be able to address quickly by offering:

One contributing metric to RFM is worth tracking independently—purchase frequency.

Lean on our loyalty program as a vehicle to entice these customers to spend again. As an example, offer more points for more rewards, such as bonus points for exceeding a certain total purchase value over a period of time or additional benefits like free or expedited shipping. Marketing strategies should include key loyalty communications to members reminding them when they’ve earned a reward they can apply to their next purchase, or have points that are about to expire, so they may as well use them before they do. Also, to increase impulse purchases, consider offering quick expiration point infusion or rewards to increase spontaneous and unplanned member purchases.

Margin isn’t typically part of the loyalty conversation, but it should be. Loyalty can help you improve margin in the following ways:

Ulta Beauty moved from being a discount brand to a full-price brand by implementing loyalty, and the brand boasts 98% of their transactions are loyalty transactions.

Customer advocacy is something all organizations aspire to create, because it drives growth. A great loyalty program makes it easy for members to refer others and share your brand with others—and rewards them for it.

According to Margaret Molloy, Chief Marketing Officer at Siegel + Gale on the Let’s Talk Loyalty Podcast episode #170:

“Your brand or program gets as much as 64% of your existing customers recommending it to others.”

This is a relatively new metric. Thank you Fred Riechheld for bringing this forth in your new book, Winning on Purpose: The Unbeatable Strategy of Loving Customers. Earned growth measures the revenue growth generated by returning customers and their referrals.

Customer Earned Growth Rate mandates companies to start thinking about classifying their buyers as earned or bought. It can help you ascertain that a large customer acquisition cost may be incurred to acquire customers which won’t prove to be sustainable in the future. Fred Reichheld ran a test on this factor with teams at Bain & Company and Medallia. According to the research, this showed to enable effective collaboration between different verticals and the results are impressive.

“Around 90% of new customers in these companies’ loyalty programs are joining because of recommendations and referrals.”

Loyalty isn’t a set and forget proposition. It requires ongoing communication and updates as well as a mutual value exchange that benefits both your brand and members. Your loyalty program must resonate with prospects who become members, and your program must align with their behavior and preferences. Give members plenty of great reasons to engage and refer others. Keep your messaging and promotions fresh. The best way to ensure success is by establishing meaningful KPIs and analyzing your customer datasets regularly.

Annex Cloud uses a proven success process to ensure your loyalty program is designed and developed based on customer needs and business goals. We’re with you every step of the way to continually monitor performance and apply best practices. Let’s talk about how to make the most of your loyalty program.